What a ride 2023 has been so far for businesses across the province and beyond! The sheer scale of compounding factors being vollied at companies as they try to regain balance and grow their income is farsical. How does anyone project into the future and plan for growth, or perhaps conservation, when so many opposing factors are at play. I’ve outlined Five Takeaways that we are seeing play out in the industrial asset class, from leasing, to sales, construction costs to trends and opportunties.

Read MoreWhile the transitions through business cycles can affect consumer confidence and create uncertainty in the financial markets, it’s important to realize we are still a long way off from 20% interest rates, and remain, at present, in historical low territory. Having said this, it’s obvious that a 3.25% increase in the BOC benchmark rate over just a 6-month period will have some tangible consequences. I am going to outline the facts behind affordability in the commercial real estate sphere compared to 12 months ago, and outline how this is affecting our owner/user clients (those who would occupy their own building) and our investor clients (who are looking for tenanted assets with a return on their money). Spoiler alert… property values are (gradually) eroding.

Read MoreSale leaseback transactions are nothing new, but they are a worthwhile tool for all building owner-operators to understand, particularly as the capital markets tighten. Aside from financing, all other costs of doing business have concurrently increased, from labour to transportation, construction to inventory. These all affect the financial health of a business and can jeopardize the financial ratios that the banks must see maintained in order to avoid disruptions. One tool not often considered by building owners is the sale leaseback transaction which can have immediate positive outcomes for their financial statements, and perhaps even allow for further growth and expansion if implemented properly.

Read MoreI’ve discussed at length the migration of industrial occupiers and capital investment into the Alberta market over the past 18 months due to the convergence of peak levels of demand, affordable development land, available warehouse space and unsustainable pricing in other major Canadian markets. As an industrial real estate broker, I get asked frequently if I’m seeing any slowdown in the industrial market due to increasing interest rates, inflation and lingering supply chain struggles. I’ll outline here why these local and global issues are having a much diluted effect on Alberta.

Read MoreIn my last article, Where has all the distribution space gone, Alberta?, we took a superficial look at the soaring demand for warehouse space in Alberta due, in part, to the expedited shift in consumer patterns as the world dealt with COVID-19. This article will analyze how this problem, in conjunction with many other interconnected links in the supply chain, have reverberated around the world causing blockages and delays in the manufacturing, transportation and delivery of goods, and earning the name of “The Great Supply Chain Disruption”. My goal is to simplify what may be one of the most complex global issues, where no one player is steering the ship (pun intended).

Read MoreIf you’ve ever been interested in commercial real estate, and particularly investing in real estate, there are some simple calculations that you should be aware of and understand in order to determine the winners and losers for your portfolio. As you practice these calculations more often, you will be able to quickly pre-qualify potential opportunities to determine if they are viable for your pursuit, or for your existing assets, if they remain performers and worth holding.

Read MoreIn the coming months, we will be entering into a global recession, unemployment will rise, liquidity will decrease and insolvency will be the ultimate looming presence. In the short-term it will be brutal, but in the medium term, it will be okay. In this blog, I’ve outlined the potential causal effects that this pandemic will have on the various, unique commercial asset types, and where the opportunities lie.

Read MoreThe catchphrase of the moment is proving to hold its weight as we analyze commercial real estate trends leading into the new year. Canada’s Multifamily market is the strongest it’s ever been with rental rates nearing 10-year highs, apartments near 100% occupancy, and volatility remaining low. On the industrial front, demand for fulfillment space continues to reign supreme to satisfy the multiplying growth metrics in e-commerce.

Read MoreFounded by a collaborative group of local businesses and non-profit organizations, they came together with the common goal of fostering competitive tax and policy programs within the City of Edmonton to ensure all businesses and citizens can successfully grow and flourish.

Read MoreWhile activity has stayed fairly constant with regard to tenant/purchaser requirements and listings, the deal flow has been slow as most companies continue to have a low risk tolerance in Alberta. Add to this the much anticipated Federal election expected in October of this year, and there has been a mentality of hurry up and wait…until there is a change up federally that is.

Read MoreHow do we design livable, workable, and healthy spaces, by limiting unsustainable urban sprawl while concurrently avoiding densification to the detriment of quality of life? These are the most important questions for any City Plan, because while it’s obvious that the outward growth of single family neighbourhoods casts a huge financial toll on all citizens, it’s also obvious that individuals and families are choosing that lifestyle and living situation for a reason.

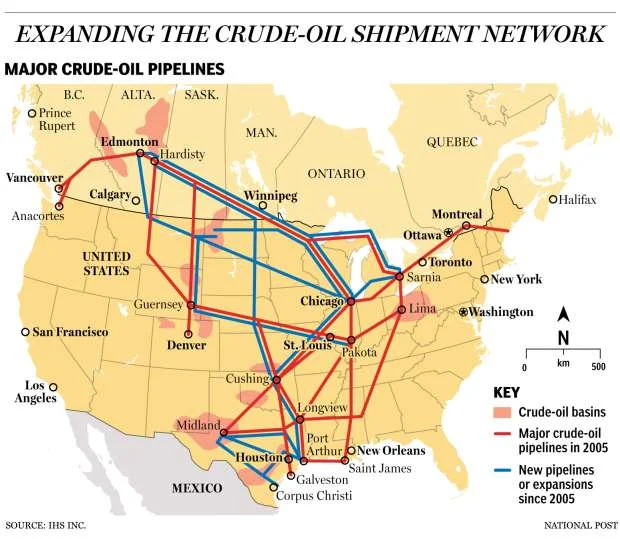

Read MoreAs it stands, Alberta’s prospects of delivering oil to tide water are grim, if not non-existent. Following the calamitous finale of the Energy East pipeline, and the mismanagement of the western Trans Mountain Pipeline, it seems that our one-customer energy policy could remain in effect indefinitely. But what if there was one more option to consider that could present significantly less inter-provincial conflict, potentially reduced cost outlays, plus economic opportunity for a struggling provincial economy. Would it not be worth investigating?

Read MoreWith 243,000 kilometres of coastline, Canada boasts the longest coastline in the world. Due to the nature of the sea ice in our northern territories, the majority of the northern coastline is untouched by human intervention and ship traffic. Due to the nature of our politics, the majority of our functional coastline in Eastern and more so, Western Canada, is blocked from viable tanker traffic. The rest of the world is aggressively trading with each other, and we’re being left in the dust.

Read MoreThe recent partnership announcement of Chinese state-owned EHL International Logistics with Edmonton International Airport clearly exhibits the positive outcomes that are starting to be realized after years of forging relationships with Chinese aviation companies. With no direct flights from Edmonton to Asia at the current time, and witnessing these Chinese state-owned companies pledge their Canadian cargo hubs to Edmonton, I’m inclined to believe that the Chinese State sees Edmonton as a positive business environment, with potential for passenger routes to follow.

Read MoreThis past week at the Edmonton Real Estate Forum, the Industrial Panel took a run at some of the huge challenges faced by industry in the Edmonton market due to the ever increasing property tax rates and reimbursement expectations from our Councillors. With over 1.5 Million square feet of industrial product under construction this past quarter (Q1 2018) and the majority being located outside of Edmonton, what more can we say.

Read MoreDid you know that in the past eight years since 2010, USA has built the equivalent of ten Keystone pipelines? Meanwhile, we're facing daily protests and delays for the Trans Mountain pipeline, a 980 km (610 mile) expansion project.

Read MoreThe majority of the Top 20 Cities selected, slimmed down from 238 submissions, are located in Eastern USA. But more interesting to me is where the clusters lie - particularly one cluster located around Washington D.C. proper, with three potential locations within neighboring counties. Where the big banks and pharmaceutical giants used to dominate the US lobbying industry, flexing their economic muscle, the new player in town is the tech industry, and in a big way.

Read MoreIn an article published today by the Financial Post, Earnest Research has analyzed debit and credit transaction data to reveal that 89% of all holiday spending, beginning after American Thanksgiving and ending at Christmas, was captured by the retail giant Amazon. The close second? Wal-Mart at a whopping 4.4%.

Read MoreWhile the industrial and commercial markets in Alberta have been far from a pretty picture, The North American industrial market as a whole has experienced a record-setting run, registering some of the strongest leasing tallies and tightest market conditions on record. In particular, the industrial market in the United States, largely due to the huge growth in e-Commerce, has been unstoppable.

Read MoreThe Butterfly Effect perpetuates that "something as small as the flutter of a butterfly's wing can ultimately cause a typhoon half way around the world" - Chaos Theory. Although the oil & gas market is more of a behemoth than a butterfly, the trends that it maps out have an enormous ripple effect on nearly all other industries, especially in our "diversified" province of Alberta. See my latest video where I discuss this effect here...

Read More