The Reincarnation of our Dying Malls

there is a pulse...

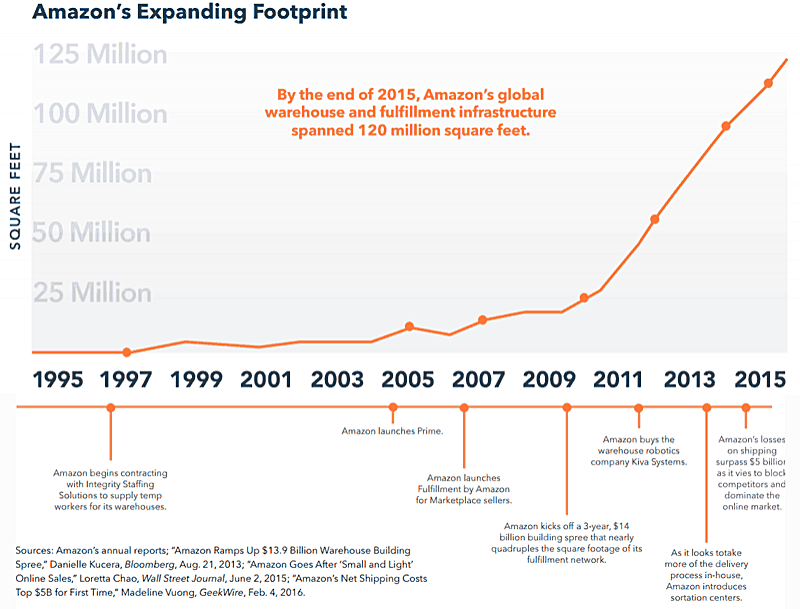

After months, or rather years, of doom and gloom for the derelict malls that encompass huge swaths of land in our urban epicenters, a pathway has presented itself for the landowners of these properties. No, many retail brick and mortar stores have not made a comeback, and yes Amazon is still taking over the world (see infographic below).

One solution to the woes of these Class B and C malls that are slowly bleeding out is their conversion into warehouse space for the ever growing and expanding E-Commerce market that cannot eat up distribution space quickly enough. "A mall is roughly 110 acres. It has power, water, a ring road, a huge parking lot. All that infrastructure has been built and permitted, and in place, so you have two scenarios. You can attempt to reuse the existing structures, or you can scrap them.” (Retaildive.com)

It is important to note however, that not all malls are feeling this pain right now. "A-class malls are thriving, due to a premier selection of retail and restaurant tenants that successfully target the affluent communities they serve. However, B and C-class malls are struggling to find customers and keep tenants, as anchor department stores such as Macy's and Sears, and fashion retailers such as Payless, BCBG and The Limited continue to shutter." (Retaildive.com)

The reason these mall sites have caused such interest in the industrial warehouse market is their ideal and strategic locations near highways and large residential bases. With the demand for instantaneous delivery steadily increasing, warehouse to front door, e-commerce distributors are having to think outside the box to find locations that are as close to their user base as possible while also having the capacity for large distribution centres and networks.

Distribution Facility

DEAD MALL

Developers must look at the infrastructure of old malls to determine if there is a method of utilizing the bones of the building for a warehouse requirement, or if it makes more sense to scrap the structure and start from fresh on these prime land sites. The biggest struggle developers tackle is obtaining public approval for these drastic conversions as it requires acceptance that the mall is in fact dead. The easiest way to get this public support is by proving that these new distribution facilities can provide much needed jobs to the local market and economy and provide life to an unproductive land site. This generally is an easy task for growing e-commerce companies; "Amazon, for instance, said earlier this year it plans to hire 100,000 full-time and 30,000 part-time workers in the U.S. by mid-2018." (WSJ.com)

This conversion movement is progressing as we speak, and we will continue to see old malls redeveloped into new warehouses (as well as other uses) in the years to come. For example, "In North Randall, Ohio, Amazon is considering the site of the former Randall Park Mall as a fulfillment center." Meanwhile, "In Mesquite, Texas, FedEx Corp. next month will open a 340,000 square-foot distribution facility on what once was the site of the former Big Town Mall, located along U.S. Highway 80 in Texas." (WSJ.com).

Those who are able to adapt will succeed; those who don't will fail.