Why Price Per Foot Should Guide Your Acquisition Strategy

It’s no secret that site and building fundamentals are a major consideration of any investment strategy into commercial real estate assets. Teams of analysts are employed to peel back the layers of the onion in order to paint a clearer picture of present value, market dynamics, and exit strategy on investment assets, from value-add to core plus. And while analyzing the yield of a property forms the basis of investment strategy, I would argue that an equally important consideration is the “price per pound” as many would call it, being the sale price divided by the total leasable square feet.

Especially important for value-add or opportunistic investments which will require repositioning and stabilization, the price per square foot forms the foundation of the asset value when considering replacement costs, improvement costs, and vacancy. The value of any commercial asset is fluid, and fluctuates depending on the person valuing the asset, as well as any number of dynamic market or asset characteristics. These can include:

Macro Economic Factors such as inflation, interest rates, supply chain fundamentals, etc.

Micro Economic Factors such as tenant demand, availability of supply, new construction pricing, etc.

Asset Characteristics such as location, age, structural capital requirements, strength of tenants, vacancy, net operating income, etc.

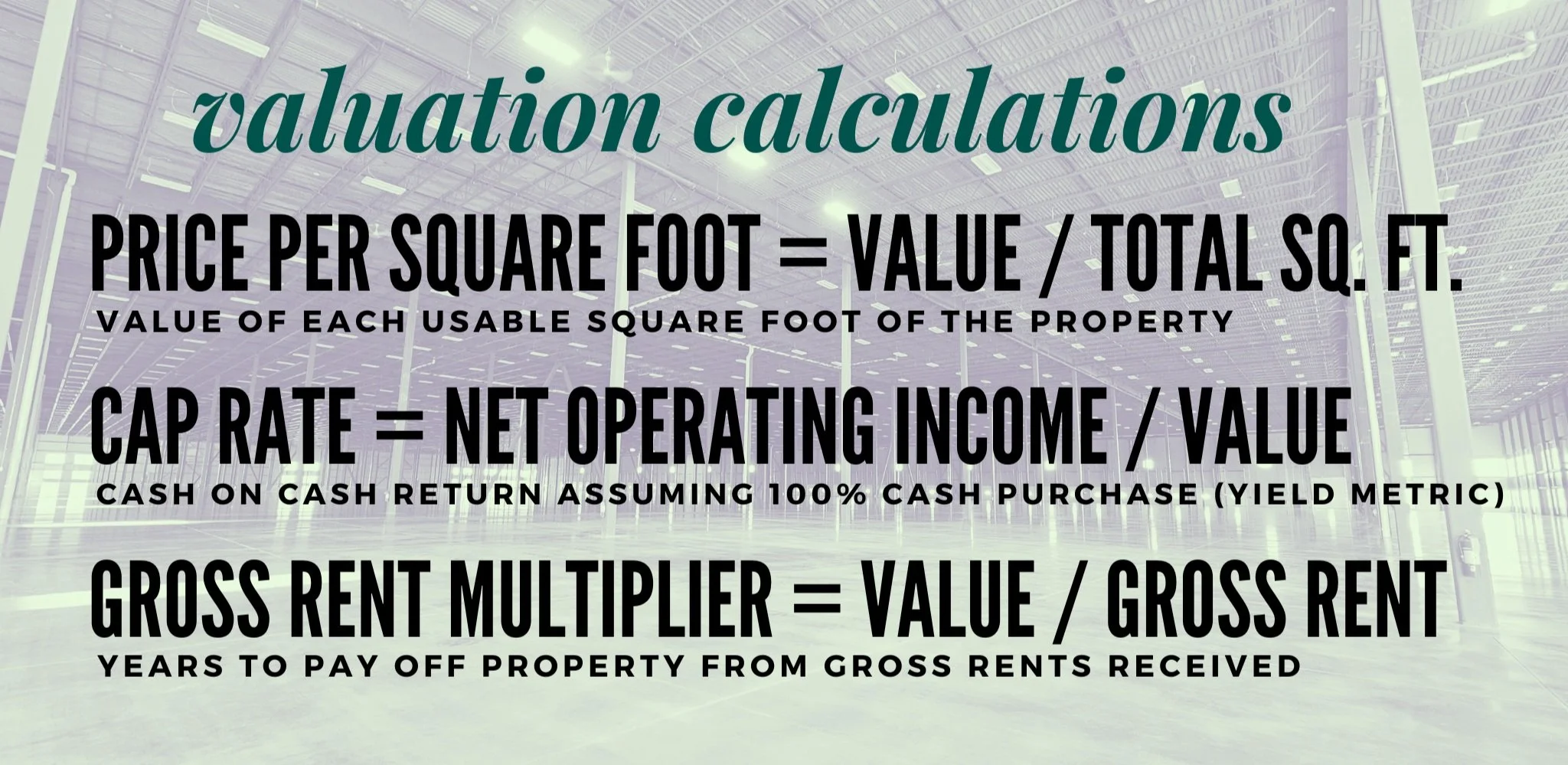

When pricing an asset, these multitudinous factors are considered to determine a “point in time” valuation, and thus, a “point in time” cap rate is derived. As a refresher, the capitalization rate is calculated by dividing the net operating income by the sale price. This calculation has become commonplace in assessing asset values for investors as it essentially determines the expected cash on cash return if the asset was purchased all cash. This is often not the case as many investors utilize varying degrees of leverage in their acquisition strategy, but it provides a base point to negotiate a sale price that would be in line with market, and support the risk threshold of the purchaser.

The cap rate is a preliminary and useful tool when analyzing the value of a stabilized commercial real estate asset with recurring cash flows in the form of rental income. However, once the asset transcends into the not stabilized category, whereby it is experiencing vacancy or requiring improvements, the price per square foot is a more useful tool. Without long-term, stable income, a purchaser is simply buying a building, and the building needs to meet market fundamentals by aligning with recent comparable sales transactions, replacement/improvement costs, and current market lease rates.

Ultimately, every investor has their own metrics and calculations that they utilize to determine asset value. There is a place and time for everything, so what analysis is most important to your investment due diligence?

Below are three common calculations to determine and assess value, in addition to understanding the replacement costs and the prices of recent, comparable sales transactions.