The Four Commercial Real Estate Investment Strategies

Note: This Blog reads and views better in Browser rather than over Email for Subscribers. Click Title Link Above.

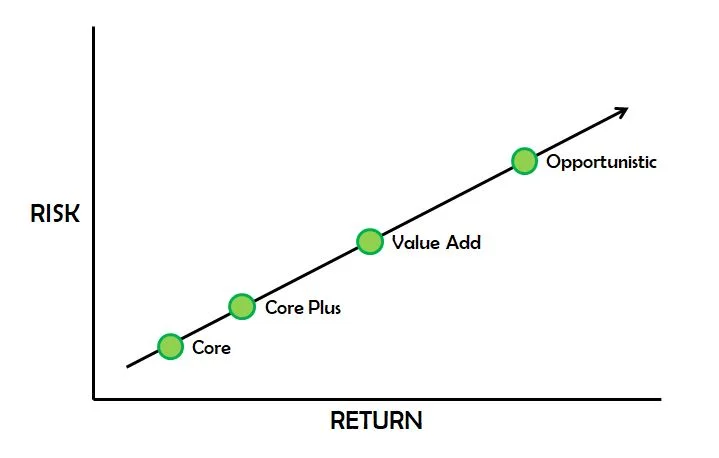

Core, Core Plus, Value Add and Opportunistic are terms used to define the risk and return characteristics of a real estate investment. They range from conservative to aggressive and are defined by both the physical attributes of the property and the amount of debt used to capitalize a project. Have a look at the following videos and sections, where I’ve briefly explained the differences between the four strategies. These are undoubtedly much more complicated than I’ve delved into, but you get the gist!

Core

Core property investors are conservative investors looking to generate stable income with very low risk. A core property is of the highest quality and location, requires very little asset management, and is typically occupied with credit tenants on long-term leases.

Asset Type: Class A Assets, Single or Multi-Tenant Premiere Properties

Market: Gateway Cities, Strong and Diversified Metropolitan Areas

Occupancy: Fully Occupied/Leased with Stable, Long-Term Credit Tenants

Cash Flow & Growth: Stable Cash Flow Investment, Predictable Annual Returns, Low/No Growth

Leverage (Financing): Low Leverage, Generally Between 0% - 40% Debt to Capitalize Transaction

Asset Management: Modest Asset Management Required.

Risk: Lowest Risk

Core Plus

Core Plus property owners typically have the ability to increase cash flows through increasing quality of tenants, slight property improvements, or management efficiencies. Similar to core properties, these properties tend to be of high-quality and well-occupied. The term "Core Plus" was originally defined as "Core" plus leverage, or leveraged core.

Asset Type: Class A Assets, Single or Multi-Tenant Premiere Properties

Market: Gateway Cities, Strong and Diversified Metropolitan Areas

Occupancy: Mostly Occupied/Leased with Fewer Quality Credit Tenants (Some Vacancy Risk)

Cash Flow & Growth: Generally Stable Cash Flow, Some Potential for Growth

Leverage (Financing): Moderate Leverage, Ranging from 30% - 60% Debt to Capitalize Transaction

Asset Management: Modest Asset Management Required.

Risk: Low to Moderate Risk

Value Add

Value add properties often have little to no cash flow at acquisition but have the potential to produce a tremendous amount of cash flow once the value has been added by capitalizing occupancy issues, management problems, and/or deferred maintenance to improve the return potential. It involves taking an under-performing asset, improving it in some manner, and divesting it for some gain.

Asset Type: Class A and B Assets or Land Acquisition, Mispositioned Property

Market: Recovering Primary Markets, or Secondary/Tertiary Markets

Occupancy: Mid to High Vacancy with Releasing Risk, Below Market Rents, Low Quality Tenants

Cash Flow & Growth: Mix of Some Cash Flow with High Opportunity for Appreciation

Leverage (Financing): Higher Leverage, Ranging from 40% - 70% Debt to Capitalize Transaction

Asset Management: High Levels of Asset Management Required to Reposition Opportunity.

Risk: Moderate to High Risk

Opportunistic

Opportunistic is the riskiest of all real estate investment strategies where investors take on the most complicated projects, often not seeing a return for many years. Examples include ground up development, acquiring a vacant asset, land development and repositioning a building from one use to another in a speculative manner, or repackaging of portfolios.

Asset Type: Class A, B or C Assets, Land Acquisition, Asset Redevelopment or Repositioning, New and Innovative Product Types

Market: Secondary/Tertiary Markets or New Developing Markets, Speculative

Occupancy: Mostly Vacant with Potential for Turnaround

Cash Flow & Growth: Often No Cash Flow at Acquisition, Highly Growth-Oriented Investment

Leverage (Financing): Moderate Leverage, 60% - 70% or More Debt to Capitalize Transaction

Asset Management: Very High Asset Management Required.

Risk: Highest Risk

I hope these videos and blurbs provided more insight, however when in doubt, just remember the following chart: