The Reality of the Leduc/Nisku Industrial Market - Are There Really Bargains?

I recently conducted an exercise in analyzing the industrial sales that occurred in the Leduc and Nisku markets over the past two years since the oil market began to collapse in Alberta. The question was how sale prices of properties have been affected as vacancy increased, and how were these prices affected by the size of the building.

On a broader scale, when you look at the utility of certain types of buildings for users, there are some property types that can work for many users and other properties that only work for a select few. In the Leduc/Nisku markets, what we have seen is buildings that range from about 5,000 SF – 15,000 SF, especially if they have a yard component, are the most utilized and sought after buildings as they work for start-up businesses, large and medium sized businesses with multiple locations or businesses that due to micro/macro circumstances, are shrinking into smaller properties. Accordingly, these properties have maintained sale values through the downturn much more effectively than larger or more unique properties. Buildings over +/- 20,000 SF have fewer users, which forces competition among the vendors and landlords.

Looking statistically, there were about twenty-two sale transactions in Leduc and Nisku between January 2015 and December 2016, fourteen of which were 15,000 SF and less, while eight were around 20,000 SF and more, with both sets of data averaging around 14-15% site coverage ratio. The average sale price per square foot of properties 15,000 SF and less was $262/SF in 2015 and 2016. The average sale price per square foot of properties around 20,000 SF and more was $169/SF in 2015 and 2016. Clearly, these values are about $100/SF apart based solely on the difference in size and the quantity of users demanding the product.

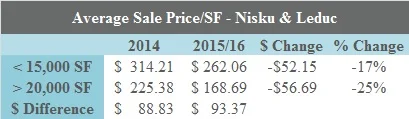

I further wanted to analyze how these values have changed since 2014, which we in the industry would consider the peak of the market in Leduc and Nisku, the height of the oil boom. I compiled the same data sets for 2014 and was interested to see in that year alone, there were nineteen sale transactions in Leduc and Nisku, only a few less than the next two years combined. When looking at all the buildings sold 15,000 SF and less, the average sale price in 2014 was $361/SF, however this included a couple outliers which sold for $764/SF and $739/SF due to extremely low site coverage ratios of 2%. When removing the two lowest and highest outliers, the average price per square foot for this data set adjusts to $314/SF – still quite elevated. Conversely, looking at the sale transactions of properties 20,000 SF and more in 2014, the average was site coverage was 13%, with sale prices contracting at $225/SF, still nearly $90/SF different than the smaller buildings.

Overall, buildings 15,000 SF and less, have maintained values of around $90/SF more than buildings that are 20,000 SF and more in the Nisku/Leduc markets over the past three years. However, from 2014 to present, all prices have dropped about $55/SF across the market, irrespective of size. Important to note though, is that for smaller buildings, although there are rumblings of blowouts and steals, the statistics show that prices have maintained very high sale values through the ups and the downs in this predominately oil and gas market.

If you would like further information on this market or any other market, please contact me and I would be happy to assist you in understanding the realities through current available product and recent sale transactions.